Managing Invoices

When you click an invoice’s row on the Invoice grid, a page displays its details. In this topic, you can learn more about:

-

Editing Invoice Details which further details Value Overrides and Term Overrides overrides and Source Fields.

-

Understanding Invoice Changes, including Delivery Data Changes, Finance Manual Changes and Future Periods, and Sales Changes in Finance.

Invoice and Deal Details

On the very top bar, you see the following details in the middle.:

-

Invoice Name

-

Deal ID

-

Revision Status (If the deal is undergoing a revision in Sales, a red X icon appears to warn the user that its source may be changing. This is the only field that reflects a real-time state in the Sales module.)

-

Invoice ID

-

Lock Status

-

Invoice Status (This only appears if the Finance workflow was enabled when the invoice was created.)

On the far right of the top bar, icons appear:

-

The Notes icon opens the notes popup that also appears in the Sales and Order modules. Notes shared from a Deal or another Invoice for the same deal appear here. You can add notes from Finance to share back. When there are unreviewed notes an orange dot appears. The lock status or invoice status does not affect when you can or cannot add or review notes. The note details cannot appear in the Finance export.

-

The Notifications icon gives you access to files as you export them as well as notifications from other modules.

-

The Audit icon provides access to the invoice audits.

-

Your initials provide access to documentation, user preferences, and the log-out function.

Below that are invoice level action buttons or fields.

-

Change Status changes the status if the Finance Workflow is enabled and you have the Change Status Execute permission.

-

Lock Actions this changes the Lock Status if you have a lock, unlock, or reset permission. Available actions depend on permissions, Lock Status, and Invoice Status.

-

Export opens the export options window. The available actions depend on permissions and Invoice Status.

-

Assignee shows the current assigned users and lets you add or remove users if you have the Can Assign Invoice permission. The Can Be Assigned Invoice permission controls which users appear for selection. These users are responsible for the invoice within the Finance module. The Invoice Status and Lock Status do not affect this field.

-

Finance Team shows the current Finance Team and lets you change it if you have the Can Assign Invoice permission. The drop-down list contains the Sales Team, Finance Team, and the teams you belong to. You cannot assign an invoice to another team to which you are not a member. Type ahead support lets you search for a team. The Invoice Status and Lock Status do not affect this field.

Below that are invoice-related total fields.

|

Field |

Description |

|---|---|

|

Invoice Units |

The sum of the Invoice Units for all invoice lines in the invoice. |

|

Gross Invoice Amount |

The sum of the Gross Invoice Amount for all invoice lines in the invoice. |

|

Net Invoice Amount |

The sum of the Net Invoice Amount for all invoice lines in the invoice. |

|

Recognized Revenue |

The sum of the Recognized Revenue for all invoice lines in the invoice. |

|

Cumulative Invoice Units |

The sum of the Invoice Units for all invoice lines in this invoice as well as any invoices earlier than this one for the same deal. |

|

Cumulative Gross Invoice Amount |

The sum of the Gross Invoice Amount for all invoice lines in this invoice as well as any invoices earlier than this one for the same deal. |

|

Cumulative Net Invoice Amount |

The sum of the Net Invoice Amount for all invoice lines in this invoice as well as any invoices earlier than this one for the same deal. |

|

Cumulative Recognized Revenue |

The sum of the Recognized Revenue for all invoice lines in this invoice as well as any invoices earlier than this one for the same deal. |

A Show More link displays additional fields from the Sales module deal.

-

Deal Net Cost

-

Advertiser

-

Agency

-

Primary Salesperson

-

Sales Team

-

Terms & Conditions

-

Billing Terms

-

Currency

Invoice Line Details

Within an invoice, you can see a grid with the invoice line details. Each invoice line corresponds to the portion of a Sales line item invoiced within the billing period.

You can set which columns appear using the Columns drop-down and that choice is remembered by your browser until you clear your browser cache/cookies. Some of the columns correspond to Finance module data and some of them are based on the data from the Sales module when the deal was last made Active. The Finance module only reflects the data in the Sales module when it completely moves through the configured workflow status for your environment.

The following fields can be seen for an invoice that is not locked depending on which columns you choose to display. By default, some of these fields are hidden.

|

Field |

Description |

|---|---|

|

Invoice Line ID |

This is the unique key for the invoice line item and should not change unless a very disruptive change is made, such as changing the calendar. At this time, changes like that are not supported. |

|

Line Item ID |

This is the line item ID integer from the Sales module that is unique across all deals. |

|

Notes |

The Notes icon opens the notes popup that also appears in the Sales and Order modules. Notes shared from the invoice, a Deal Line Item in Sales, or another Invoice Line for the same deal line appear here. You can add notes from Finance to share back. When there are unreviewed notes an orange dot appears. The lock status or invoice status does not affect when you can or cannot add or review notes. The note details cannot appear in the Finance export. |

|

Line Item Number |

This is the line item ID from the Sales module that is unique only within the specific deal. It may be a decimal when dealing with packages. |

|

Line Item Name |

This is the name of the line item in the Sales module. |

|

Start Date |

This is the line item Start Date from the Sales module. |

|

End Date |

This is the line item End Date from the Sales module. |

|

Product ID |

This is the unique ID for the line item’s product. When billing on a package parent, it is the package ID. |

|

Product Name |

This is the name for the line item’s product. When billing on a package parent, it is the package name. |

|

Package ID |

For packages, this is the package ID whether you are billing on the package or the children. When billing on a package (package is Can Invoice=true), this same value appears in Product ID. When billing on the child, this shows the parent package. |

|

Package Name |

For packages, this is the package name whether you are billing on the package or the children. When billing on a package (package is Can Invoice=true), this same value appears in the Product Name. When billing on the child, this shows the parent package. |

|

Parent Line Item ID |

For children of packages, when billing on the children, this is the deal line item ID for the group/package line in the Sales module. |

|

Parent Line Item Name |

For children of packages, when billing on the children, this is the deal line item name for the group/package line in the Sales module. |

|

Unit Type |

This is the metric used for the Units as set on the deal line item. |

|

Gross Unit Cost |

This is the Gross Unit Cost from the line item in the Sales module. |

|

Gross Cost |

This is the Gross Cost as sold in the Sales module. It does not reflect actuals and is not calculated by the Finance module. |

|

Net Unit Cost |

This is the Net Unit Cost from the line item in the Sales module. |

|

Quantity |

This is the sold Quantity from the Sales module. It does not reflect actuals and is not calculated by the Finance module. |

|

Net Cost |

This is the Net Cost as sold in the Sales module. It does not reflect actuals and is not calculated by the Finance module. |

|

Cost Method |

This is the Cost Method sold in the Sales module. |

|

Comments |

This supports up to 255 characters of free text that a Finance user can optionally leave for other users to see or for exporting with the lines. This field is editable whenever the Invoice Units, Net Invoice Amount, Recognized Revenue, and terms are editable. The same rules around lock status, workflow status, and permissions apply to the Comments field as those other fields. When an invoice is locked, if you use adjustments, you can use an Adjustment Comments field instead.. |

|

Invoice Units |

One of the core Invoice Values, these are the billable units for the invoice line item as calculated or specified in the Finance module. By default, the system sets them based on the Unit Terms, which default from the Invoicing Organization. A user can manually type another positive whole number, so long as it does not exceed the Quantity when Capping is enforced. Typing another number here sets the Unit Terms and Unit Source to Manual on Save. |

|

Cumulative Invoice Units |

This is the total Invoice Units for the deal line up to and including this invoice. It is these Invoice Units plus those for any invoice lines for the same deal line for billing periods earlier than this period. For example, if the line item runs from July through December and the row’s invoice line is for September, it reflects July, August, and September. |

|

Unit Terms |

This shows which Invoice Terms calculate Invoice Units. These defaults are based on the Invoicing Organization, but a Finance user can change this. If you change Unit Terms, the Invoice Units update based on the calculation for those terms. If you change this, Unit Source is set to Manual. |

|

Net Invoice Amount |

One of the core Invoice Values, this is how much you bill for the invoice line item as calculated or specified in the Finance module, calculated by the system. By default, the system sets them based on the Amount Terms, which default from the Invoicing Organization. A user can manually type another positive number, so long as it does not exceed the deal line item’s Net Cost when Capping is enforced. Typing another number here sets the Amount Terms and Amount Source to Manual on Save. |

|

Cumulative Net Invoice Amount |

This is the total Net Invoice Amount for the deal line up to and including this invoice. It is this Net Invoice Amount plus those for any invoice lines for the same deal line for billing periods earlier than the invoice. For example, if the line item runs from July through December and the row’s invoice line is for September, it reflects July, August, and September. |

|

Gross Invoice Amount |

This is the gross value for how much you bill. How this calculates depends on the Amount Terms. If the Amount Terms are NOT Manual, then it uses the same calculation as the Net Invoice Amount but substitutes the Gross Unit Cost for the Net Unit Cost and substitutes the Gross Cost for the Net Cost to determine the cap. However, if the Amount Terms are Manual, the system calculates the Gross Invoice Amount using a ratio of the Net Invoice Amount:

|

|

Amount Terms |

This shows which Invoice Terms calculate Net Invoice Amount. These defaults are based on the Invoicing Organization, but a Finance user can change this. If you change Amount Terms, the Net Invoice Amount updates based on the calculation for those terms. Changing this sets Amount Source to Manual. |

|

Recognized Revenue |

One of the core Invoice Values, this is the revenue you recognize for the line item. By default, the system sets them based on the Revenue Terms, which default from the Invoicing Organization. A user can manually type another positive number, so long as it does not exceed the deal line item’s Net Cost when Capping is enforced. Typing another number here sets the Revenue Terms and Revenue Source to Manual on Save. |

|

Cumulative Recognized Revenue |

This is the total Recognized Revenue for the deal line up to and including this invoice. It is this Recognized Revenue plus those for any invoice lines for the same deal line for billing periods earlier than the invoice. For example, if the line item runs from July through December and the row’s invoice line is for September, it reflects July, August, and September. |

|

Revenue Terms |

This shows which Invoice Terms calculate Recognized Revenue. These defaults are based on the Invoicing Organization or product, but a Finance user can change this. If you change Revenue Terms, the Recognized Revenue updates are based on the calculation for those terms. Changing this sets Revenue Source to Manual. |

|

Unrecognized Revenue |

This is calculated as:

|

|

Deferred Revenue |

This is calculated as:

|

|

Primary Performance |

This is the uncapped delivery data for the invoice line’s dates from the first-party publisher system when available within AOS. |

|

Third-Party Performance |

This is the uncapped delivery data for the invoice line’s dates from the deal line’s Billable Third-Party Server when that data is available within AOS. |

|

Remaining Amount |

This is calculated as:

|

|

Remaining Units |

This is calculated as:

|

|

Suggested Unit Terms |

These are the Invoice Terms for units as specified by the invoicing organization or the Sales user. A Finance user can override the terms if the invoice is not locked and those overridden terms appear as the Unit Terms. The Suggested Unit Terms continue to show what the terms were the last time the deal went active even when a Finance user changes them. |

|

Suggested Units |

These are the Units based on the Sales terms, typically for contracted values. |

|

Suggested Amount Terms |

These are the Invoice Terms for the amount as specified by the invoicing organization or the Sales user. A Finance user can override the terms if the invoice is not locked and those overridden terms appear as the Amount Terms. The Suggested Amount Terms continue to show what the terms were the last time the deal went active even when a Finance user changes them. |

|

Suggested Amount |

This is a version of the Invoice Amount based on the Sales terms, typically for contracted values. |

|

Unit Source |

This shows how Invoice Units derived their Invoice Terms. It is one of the following:

|

|

Amount Source |

This shows how Net Invoice Amount derived its Invoice Terms. It is one of the following:

|

|

Revenue Source |

This shows how the Recognized Revenue derived its Invoice Terms. It is one of the following:

|

|

Last Billing Period |

This shows whether this is the last invoice line for a deal line.

|

| Station |

This shows the Station + Markets if one was set for the line item within the Sales module. Packages do not show stations of their children. If your export includes non-invoice child lines, those child lines will show their stations in the export. |

When an invoice is locked, if the Adjustments Feature is enabled, additional columns appear.

Below the grid are page links and a drop-down to specify how many rows should appear at a time.

Editing Invoice Details

Within the Invoices grid, when an invoice is not locked and your roles have update permission, you can modify the core invoice values and their terms:

-

The core Invoice Values are editable by typing in a new number over a number calculated by the system:

-

Invoice Units – Billable quantity for the line within the period.

-

Net Invoice Amount – Monetary value to bill for the line within the period.

-

Recognized Revenue – The monetary value to recognize internally for the line within the period.

-

-

The Invoice Terms are editable with drop-down lists which in turn update the corresponding invoice values:

-

Unit Terms – The calculation used to calculate the Invoice Units.

-

Amount Terms – The calculation used to calculate the Net Invoice Amount.

-

Revenue Terms – The calculation used to calculate the Recognized Revenue.

-

Value Overrides

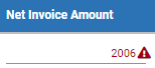

When you manually enter a number for the Invoice Units, Net Invoice Amount, or Recognized Revenue, a few things happen:

-

The Finance module checks for capping if Capping is enabled for the line. If the value exceeds the cap, the Save button is disabled and a red caution icon prevents saving until the value is corrected.

For Net Invoice Amount or Recognized Revenue, capping compares the Net Cost with the sum of the value you type plus the values for any earlier billing periods for the same line item. For Invoice Units, capping compares the Quantity.

Note: If for some reason, an invoice later than the one you edit was locked or manually edited, those future invoices are also considered by the cap, but this is typically not a common use case.

-

The font of the field becomes blue when it is edited.

-

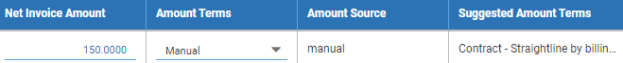

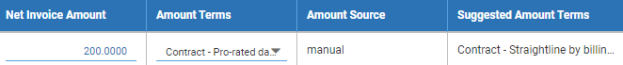

The corresponding terms change to Manual. For example, if you manually type in a number for the Net Invoice Amount, the Amount Terms change to Manual.

-

The corresponding source field (Unit Source, Amount Source, Revenue Source) also changes to Manual. This shows how the Terms came to be applied. The Suggested Terms maintain the original value of the terms before you made a manual edit. You can add the source and suggested terms fields to the grid using the Columns drop-down on top.

-

Any changes from the Sales module are no longer applied when the terms field is Manual.

-

Future periods update when you save as explained in Finance Manual Changes and Future Periods to account for changes when you save so long as someone did not lock or manually enter a number within those future periods.

-

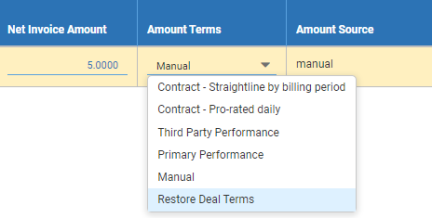

After you save an edit, an option appears in the terms drop-down lists to restore the system terms and revert the manual edits. For Amount Terms and Unit Terms, this is Restore Deal Terms and for Revenue Terms, this is Restore Default Terms. This resets the terms and source and refreshes values. For example, the system calculates $100 for the Net Invoice Amount based on Third Party Performance and you manually change it to $50, thereby setting Amount Terms and Amount Source to Manual. A Restore Deal Terms option appears under Amount Terms, and selecting this sets the Invoice Amount back to the Suggested Amount Terms of Third Party Performance which then sets the Net Invoice Amount back to $100. This also sets the Amount Source back to Invoice_Schedule.

Note: Be aware of a number of things:

-

Changing the Invoice Units does NOT automatically recalculate the Net Invoice Amount unless the Amount Terms are Units Sync.

-

If the Amount Terms are Units Sync, then changing the Invoice Units updates the Net Invoice Amount.

-

If the Revenue Terms are Units Sync, then changing the Invoice Units updates the Recognized Revenue Terms.

-

Related read-only fields derived from the units, amount, and revenue are recalculated only after you save. These include Gross Invoice Amount, Cumulative Units Invoice, Cumulative Net Invoice Amount, Cumulative Recognized Revenue, Unrecognized Revenue, Deferred Revenue, and Remaining Amount.

Term Overrides

When you change the Unit Terms, Amount Terms, or Revenue Terms rather than the actual values of the units, amount, and revenue, a few things happen:

-

The corresponding invoice value is updated. For example, if Amount Terms are Primary Performance, and you change them to Contracted – Prorated, the Net Invoice Amount recalculates by prorating the Net Cost.

-

The font of the value becomes blue.

-

The corresponding source changes to Manual.

For example, because the Amount Terms were changed, Amount Source is manual and Net Invoice Amount is in a blue font. The Amount Source shows that the Amount Terms were manually set and not those chosen by the organization or Sales user. You can see the original terms in the Suggested Amount Terms field.

-

When the source is Manual, the terms cannot change based on what happens in Sales. However, changes to costs, dates, and quantity from Sales are considered using the terms that are set in Finance. For example, if the terms were Third-Party Performance and the Finance user changes them to Primary Performance, if the deal's Quantity is increased or lowered, the cap is recalculated based on the primary performance and new delivery is used as it arrives. However, if the Sales user changes terms, the new terms from Sales are ignored after the terms are changed in Finance.

-

When the terms are Manual (as opposed to the source being Manual), no changes from Sales, performance or earlier periods are considered because the Finance user manually entered the value they claim as final. However, this corresponds to the specific field. If the Amount Terms are Manual but the Unit Terms are Primary performance, the Invoice Units will still update if new delivery comes in or a change occurs in Sales to lower the Quantity.

-

When the source is Manual, the terms include an option to restore the system terms and revert the manual edits. This resets the terms and source and refreshes values. For example, the line was originally set to use Third Party Performance and you manually change the terms to Primary Performance. The restore option resets it back to Third Party Performance

Changing the terms in an invoice affects only that specific invoice line within that invoice. For example, if a line item runs for two periods and you change the first period’s terms from Third-Party to Primary Performance, the second period invoices terms remain Third-Party Performance unless they are also explicitly changed from within their own invoice.

Source Fields

Unit Source, Amount Source, and Revenue Source fields show how the corresponding terms were applied.

-

invoice_schedule means that the Amount Terms or Unit Terms came from Sales or the organization.

-

invoice_org means that the Revenue Terms came from the invoicing organization.

-

product means that the Revenue Terms came from the product.

-

manual means a user in Finance manually set the terms or that the terms got set to manual because the user manually set the value itself. When this is set to manual, restore terms options appear for the corresponding terms. For Amount Terms and Unit Terms, this is Restore Deal Terms and for Revenue Terms, this is Restore Default Terms.

Understanding Invoice Changes

Invoice data gets created or updated in a few ways:

-

Delivery information enters AOS.

-

A user manually makes changes in Finance to either Invoice Values or Invoice Terms.

-

A deal in Sales becomes active or goes through a revision workflow to return to being in an active deal.

Note: Most of the details and examples that follow assume capping is not disabled. If you have disabled capping, then each invoice line is calculated on its own without considering other invoice lines for the same deal line and many rules do not apply.

Delivery Data Changes

As delivery information enters AOS through the integration services with the external systems, Finance updates accordingly. As long as the corresponding Invoice Terms are set to look at delivery information, the values update unless the invoice is locked or prior_locked. For Third-Party Performance, a Billable Third-Party Server also must be set on the line item within Sales.

Unless Capping is overridden, delivery applies only until the cap is reached. For Invoice Units, this is a direct comparison with the Quantity. For example, if the Quantity is 5000 and the delivery is 6000, only up to 5000 Invoice Units are allowed. For the Net Invoice Amount and Recognized Revenue the 6000 delivery is first used to calculate the monetary value and then that monetary value is capped accordingly based on the Net Cost.

When a line item spans multiple billing periods, the cap only applies in total and not per period. For example:

-

Start Date: September 30

-

End Date: November 1

-

Total Days: 33

-

Quantity: 33,000

|

Period |

Primary Performance |

Invoice Units |

Unit Terms |

|---|---|---|---|

|

September |

2000 |

2000 |

Primary Performance |

|

October |

30000 |

30000 |

Primary Performance |

|

November |

2000 |

1000 |

Primary Performance |

|

Total |

34000 |

33000 |

|

In this example, November’s full delivery is not billed because it pushes the total units above the sold quantity goal.

Edge case: Typically for performance basis, a prior period does not have its number significantly changed while a subsequent period’s numbers are in place. However, if for some reason, October’s delivery was restated higher or lower after November’s delivery was already in and neither October nor November were locked, then November’s Invoice Units were updated to respect the cap accordingly based on the change to October’s delivery. For example, if October’s delivery and Invoice Units restate as 30500, November’s Invoice Units= 500. If October’s delivery becomes 29500, November Invoice Units = 1500. If October delivery is 27000, November Invoice Units = 2000. If October’s delivery becomes 32000, then its own Invoice Units cap at 31000 and November = 0 since the cap was already reached in October.

The exception to this is if, for some reason, November was locked while October was not locked OR if someone manually entered a value for November but not October. For example, if October’s terms are Primary Performance but November’s terms are Manual, then November’s value can actually apply before October in terms of the capping rules.

Finance Manual Changes and Future Periods

Updating the values within Finance for a specific invoice can also update future invoices if the line item runs in multiple periods unless capping is disabled.

For a contracted basis, if an earlier period is reduced or increased and no subsequent periods are locked or manually edited, the invoices adjust accordingly to ensure goals are met. For example, consider this line item:

-

Start Date: September 30

-

End Date: November 1

-

Total Days: 33

-

Quantity: 33,000

-

Calendar: Gregorian

|

Period |

Invoice Units |

Unit Terms |

Unit Source |

|---|---|---|---|

|

September |

1000 |

Prorated |

Invoice_schedule |

|

October |

31000 |

Prorated |

Invoice_schedule |

|

November |

1000 |

Prorated |

Invoice_schedule |

If you lower September, then October and November increase.

|

Period |

Invoice Units |

Unit Terms |

Unit Source |

|---|---|---|---|

|

September |

500 |

Manual |

Manual |

|

October |

31484 |

Prorated |

Invoice_schedule |

|

November |

1,016 |

Prorated |

Invoice_schedule |

For example, in the above, (Quantity – Past) / Remaining Days creates a new daily number that gets redistributed.

(33000 – 500) / 32 = 1015.625

If you increase September, then October and November decrease.

|

Period |

Invoice Units |

Unit Terms |

Unit Source |

|---|---|---|---|

|

September |

5000 |

Manual |

Manual |

|

October |

27125 |

Prorated |

Invoice_schedule |

|

November |

875 |

Prorated |

Invoice_schedule |

For example, in the above:

(33000 – 5000) / 32 = 875

For straight-line the calculation is simpler:

|

Period |

Invoice Units |

Unit Terms |

Unit Source |

|---|---|---|---|

|

September |

11000 |

Straightline |

Invoice_schedule |

|

October |

11000 |

Straightline |

Invoice_schedule |

|

November |

11000 |

Straightline |

Invoice_schedule |

If you lower September, then October and November increase.

|

Period |

Invoice Units |

Unit Terms |

Unit Source |

|---|---|---|---|

|

September |

5000 |

Manual |

Manual |

|

October |

14000 |

Straightline |

Invoice_schedule |

|

November |

14000 |

Straightline |

Invoice_schedule |

For example, in the above, (Quantity – Past) / Remaining Periods creates a new daily number that gets redistributed.

(33000 – 5000) / 2 = 14000

If you update the terms for one period, the future period values are updated, but not their terms. The future periods respond to the new value of the invoice line you changed but those future periods continue to use their original terms. For example, if you change the first period in the straight-line example to be prorated, the remaining periods recalculate their values but continue to be straight-lined.

|

Period |

Invoice Units |

Unit Terms |

Unit Source |

|---|---|---|---|

|

September |

1000 |

Prorated |

Manual |

|

October |

16000 |

Straightline |

Invoice_schedule |

|

November |

16000 |

Straightline |

Invoice_schedule |

Sales Changes in Finance

Finance data gets created or updated only when a deal moves completely through the Sales workflow. The exact workflow statuses are configurable and can vary from deal to deal depending on how complex your company needs AOS to be. Finance considers a deal to be Active when it is considered a fully approved contractual commitment between your company and your customer. Finance data is created for all invoices, even those in the future, and most values from Sales are frozen within Finance unless a revision is opened and moves completely back through a Sales workflow to become active again.

If an invoice is locked, Sales prevents most changes that affect Finance. In general, Sales cannot make changes that update the dates, quantity, or monetary value when an invoice is locked.

When an invoice is not locked, Sales updates it, but will not overwrite any manual edits made in Finance. Choices made in Finance take precedence over Sales. When part, but not all, of a line item is in a locked invoice, this same behavior will apply.

For example, consider this line item:

-

Start Date: September 1

-

End Date: November 30

-

Quantity: 33,000

-

Unit Cost: 10

-

Net Cost: 330

For simplicity, in this example, the Unit Terms and Amount Terms were Straightline, but a Finance user manually entered different Invoice Units for the September invoice, which set the Unit Terms to Manual and updated October and November to account for the change.

|

Period |

Invoice Units |

Unit Terms |

Net Invoice Amount |

Invoice Terms |

|---|---|---|---|---|

|

September |

5000 |

Manual |

110 |

Straightline |

|

October |

14000 |

Straightline |

110 |

Straightline |

|

November |

14000 |

Straightline |

110 |

Straightline |

If the line item changes in Sales:

-

Start Date: September 1

-

End Date: November 30

-

Quantity: 37,000 (Increase by 4000)

-

Unit Cost: 10

-

Net Cost: 370 (increase by 40)

Previously Edited

Then when the revision workflow in Sales is completed, Finance updates, but will not touch September’s Invoice Units because the Unit Terms are Manual. It will update September’s Net Invoice Amount because Amount Terms are Straightline.

|

Period |

Invoice Units |

Unit Terms |

Net Invoice Amount |

Invoice Terms |

|---|---|---|---|---|

|

September |

5000 |

Manual |

123.3333 |

Straightline |

|

October |

16000 |

Straightline |

123.3333 |

Straightline |

|

November |

16000 |

Straightline |

123.3334 |

Straightline |

Note: At this time, if a value in Sales is made lower than what was manually set within Finance, there are no controls. In a future release, a user will be warned in Finance and prevented when locking an invoice.

Locked

For a locked invoice both the amount and units would have been prevented from changing in the September invoice and only October and November would update.

|

Period |

Invoice Units |

Unit Terms |

Net Invoice Amount |

Invoice Terms |

Lock Status |

|---|---|---|---|---|---|

|

September |

5000 |

Manual |

110 |

Straightline |

Locked / Prior_Locked |

|

October |

16000 |

Straightline |

130 |

Straightline |

Unlocked / Reset |

|

November |

16000 |

Straightline |

130 |

Straightline |

Unlocked / Reset |

Non-Invoice CLIs

In the Finance module, the default export and UI show only line items where the Can Invoice field is checked within the Sales module (Can Invoice True lines). However, Finance still generates invoice values for child line items within a bottom up, allocation, or top down package when the children are not invoiced. These values are a ratio distribution of the parent’s value to ensure the sum of the children add up to roughly the parent’s value. These lines are called Non-Invoiceable Child Lines and they are not considered in Invoice totals.

Enabling Child Line Item in Exports

By default, export files do not contain child lines unless they are set to Can Invoice=True, in which case the calculations descried below do not apply. You must contact Operative support to enable the child lines in specific export files. You can have some export files that include the children and some that do not. Whether Can Invoice false child lines appear or not is a setting of each specific export template on the backend.

Generating Child Line Item Data

For each package, the system evaluates if it is eligible to have its children calculated as non-invoiceable values. All of the following conditions must be met for these calculations to be used:

-

All child line items within the group are Can Invoice=False. If even one child is set to true, then none of the children have invoice data generated for any of the Can Invoice=False lines.

-

The parent is Can Invoice=True.

-

The group type is Bottom Up, Allocation, or Top Down.

Note: For an allocation package, child line items that have zero for the Quantity in the Sales module do not appear in the Finance module at all. (Even Can Invoice=True child lines of an allocation package will not appear in the Finance module). Also, if child line item dates extend outside the dates of the parent package, then if they are Can Invoice=False, allocation package child values in the Finance module may not add up in a way that is desirable. Allocation packages are only supported with non-invoice CLIs when dates overlap as expected.

The initial generation of invoice data and an actual calculation of values are separate. Whether values can be calculated also will depend on if invoice terms are available.

Child Line Item Invoice Terms

To calculate invoice values for a child line item, the system needs invoice terms for Invoice Units, Net and Gross Invoice Amount, and Recognized Revenue. The system uses the parent line item's terms in the Finance module. However, if a user manually enters a value in the Finance module for the parent, then the children use the parent's terms from the Sales module. If the terms in Sales are also manual, Performance terms are used. For recognized revenue, if a value is overridden in Finance, the terms of the product or invoicing organization are used and if they are manual as well, then Performance is used.

For example:

All child line items within the group are Can Invoice=False. If even one child is set to true, then none of the children have invoice data generated for any of the Can Invoice=False lines.

-

If a group's parent Net Invoice Amount is set to use Third-Party Performance in the Sales module but a Finance user manually types in $100, the children still use Third-Party Performance.

-

If a group's parent Net Invoice Amount is set to use Third-Party performance in the Sales module but a Finance user changes the terms to Primary Performance using the Finance module Bulk Operations tool, the children use Primary Performance.

Child Line Item Values

For each Finance value (Invoice Units, Net Invoice Amount, and Recognized Revenue) a child line item actually has two values:

-

Uncapped value based on invoice terms. The sum of all child uncapped values might not equal the parent value because of capping and overriding.

-

Value within the group. The sum of all children within the group must equal their parent value. This is based on calculating a ratio for each child's uncapped value in the group during the period and applying that ratio to the parent's value. Gross is calculated based on the same ratio as Net.

In the example below, all line items run in a single period, are CPM, and performance based.

|

|

Quantity |

Net Unit Cost |

Net Cost |

Delivery |

Uncapped Net Invoice Amount |

Net Invoice Amount Ratio |

Net Invoice Amount (Ratio Based) |

|---|---|---|---|---|---|---|---|

| GLI | 10000 | 11.2 | 112 | 10000 | Locked / Prior_Locked | 112 | |

| CLI1 | 5000 | 10 | 50 | 4000 | 40.00 | 0.349344978 = 40 / 114.5 | 39.1266 |

| CLI2 | 3000 | 12 | 36 | 3500 | 42.00 | 0.366812227 = 42 / 114.5 | 41.0830 |

| CLI3 | 2000 | 13 | 26 | 2500 | 32.50 | 0.283842795 = 32.5 / 114.5 | 31.7904 |

| CLI Sum: | 114.5 |

The children's total delivery and total value exceeds the group because of capping. In this case, over delivery in some lines makes up for under delivery in other lines in the parent's total calculation:

-

Uncapped Net Invoice Amount is based on applying the Net Unit Cost to the Delivered because the invoice terms are performance based. This is calculated without applying capping. CLI1 has under delivered in this example but CL2 and CL3 have both over delivered. If the terms were prorated or straightline, the delivery would be ignored and values calculated based on the dates and Net Cost.

-

Net Invoice Amount Ratio determines the weight each line item holds within the group. The Uncapped Net Invoice Amount for all children are summed and then each line item's individual Uncapped Net Invoice Amount is divided by that sum to determine a ratio.

-

Net Invoice Amount applies a child's ratio to the parent Net Invoice Amount. This ensures the total of all child line items will match the parent, with minor rounding variance. This can exceed the Net Cost of the line item itself as it does for CL2 and CL3 in the example above. This is necessary to ensure the total of the CLIs adds up to the parent's value.

Be aware of the following:

-

The above example was based on Net Invoice Amount. However, all of the following are calculated for child line items when applicable:

-

Uncapped Net Invoice Amount

-

Net Invoice Amount Ratio

-

Net invoice Amount (based on ratio)

-

Uncapped Invoice Units

-

Invoice Units Ratio

-

invoice Units (based on ratio)

-

Uncapped Recognized Revenue

-

Recognized Revenue Ratio

-

Recognized Revenue (based on ratio)

-

Gross Invoice Amount is calculated by applying the Net Invoice Amount Ratio to the Gross Invoice Amount of the parent.

-

-

Complex combinations are calculated the same as the simple example. Each child line item uses invoice terms to calculate its uncapped value which is summed to find a ratio. This occurs even if dates span multiple periods or cost methods vary. Contracted cost methods (pro-rated, straightline) are also supported.

-

All sibling children use the same terms as each other based on the parent.

-

Line items for which performance terms do not calculate for an individual line item will not calculate for a child line item either. The same calculations and logic are applied to determine the uncapped value as would be applied if the child line item was an individual line item, only capping is ignored. For example, if the parent's terms are performance and a child line item is Flat Rate, no value is calculated for that line item as no value would be calculated if that line item was outside the group.

-

If a user manually overrides the parent's value by entering a new number, the Sales module terms are still applied to determine child values. For example, with the earlier example, if a Finance user manually enters $100 for the Net Invoice Amount within the invoice, child line item Uncapped Net Invoice Amount values and ratios do not change. However, the ratios are then applied to the parent $100 to recalculate the child Net Invoice Amounts (for example, 34.9345, 36.6812, 28.3843), so they add up to the $100 total of the parent.

-

When you unlock (but do not reset) an invoice, the parent GLI values do not change unless you reset them using the Bulk Operations tool. However, the child line items may recalculate for a prior_locked invoice.

-

When you unlock and reset an invoice, calculations are redone.

-

There can be some minor rounding variance when summing the children. This can slightly vary from the group parent since the same number of decimal places are used for the children and parent.

-

In the data stream, these child line items are in the non_invoiceable_cli_invoice_object.output topic.

-

The Sales module sets a hidden nonInvoiceable flag to true for packages and children that are allowed to calculate child values using the ratio approach. This nonInvoiceable flag is visible only through the API and data stream and cannot change when any part of the package is locked. Because of this, whenever a parent package is Can Invoice=True, when any part of it is locked, existing child line items cannot have their Can Invoice field changed and any added child line items must be Can Invoice=False.

-

For an allocation package, child line items that have zero for the Quantity in the Sales module do not appear in the Finance module at all. (Even Can Invoice=True child lines of an allocation package will not appear in the Finance module). Also, if child line item dates extend outside the dates of the parent package, then if they are Can Invoice=False, allocation package child values in the Finance module may not add up in a way that is desirable. Allocation packages are only supported with non-invoice CLIs when dates overlap as expected.